Online loan in the Philippines Get Instant approval in 2025

Are you looking online loan in the Philippines? it is no secret that many Filipinos face financial challenges at some point in their lives. These challenges could take the form of unexpected bills or emergencies that require immediate financial attention. Fortunately, the availability of online loans has made it much easier for people to access the necessary funds quickly without having to visit a bank. In this article, we will explore the benefits of instant approval online loans in the Philippines, the available different types, as well as the most popular loan apps.

The Benefits of Online Loans in the Philippines

In recent times, emergencies, such as sudden illness, job loss, and natural disasters, have become commonplace in the Philippines. Such emergencies usually require prompt financial intervention, and in such cases, online loans come in handy. Many instant-approval online loans in the Philippines offer funding within 24 hours of application, which makes them ideal for emergencies. With online loans, Filipinos can cover unexpected bills, pay for repairs, or purchase essential items, such as groceries.

Read More: Top Philippine Companies | Who Dominates the Business Scene

How Easy It Is to Apply for an Online Loan

Traditional loan applications are often lengthy and require extensive documentation, which can be a real hassle. Applying for an instant approval online loan in the Philippines is a straightforward process. Loan applicants only need to upload some basic documents such as a valid ID and proof of income. Most loan applications can be completed in under 15 minutes, which makes the process of getting cash a breeze.

The Different Types of Online Loans Available in the Philippines

When it comes to instant approval online loans in the Philippines, there are two broad categories: personal loans and business loans. Personal loans are unsecured loans for individuals, while business loans are financing options for businesses. Although the two categories are distinct, some lenders provide both types of loans. Personal loans have smaller loan amounts and shorter repayment periods than business loans.

Secured vs. Unsecured Loans

Another classification for online loans in the Philippines is whether they are secured or unsecured loans. Secured loans require collateral, while unsecured loans do not. Collateral can be anything of value, such as a car or property, which provides security for the lender in case the borrower defaults on the loan. Secured loans usually offer lower interest rates owing to their reduced risk factor, while unsecured loans often have higher interest rates.

Read more: Best Savings Account in the Philippines

What documents are required to apply for a personal loan in the Philippines?

To apply for a personal loan in the Philippines, the required documents typically include a valid government-issued ID such as a:

- Passport or driver's license

- Proof of income in the form of payslips or ITR (income tax returns)

- Proof of residence such as utility bills or a lease agreement

- And bank statements for the past three months

Other additional requirements may include a completed loan application form and collateral for certain loan types. It is best to check with the specific lender for their exact requirements and qualifications before applying.

Instant Approval Online Loans Apps in the Philippines

Digido Philippines online loan

Digido is a relatively new online loan platform in the Philippines, offering personal loans. The loan application process is straightforward, with applicants only needing to provide some basic information such as their name, age, and income. Digido does not require collateral and offers loan amounts ranging from PHP 10,000 to PHP 50,000. Additionally, the repayment period for Digido loans is flexible, ranging from three to 12 months. The interest rate for Digido loans ranges between 4.5% to 18%.

Loan Ranger

Loan Ranger is an online another best platform that provides unsecured personal loans to Filipinos. It offers amounts between PHP 3,000 and PHP 10,000 with repayment periods ranging from seven to 30 days. Loan Ranger's application process is completely online, with applicants only needing to upload the necessary documents. The interest rate for Loan Ranger loans can vary depending on the borrower's credit score.

Cashwagon

Cashwagon is an online lending platform that offers a variety of loan types, including personal loans, medical loans, and salary loans. The platform provides loan amounts between PHP 2,000 and PHP 20,000, with repayment periods ranging from seven to 60 days. Cashwagon does not require collateral and offers a fast approval process. The interest rate for Cashwagon loans varies based on the loan amount and repayment period.

Tala Philippines

Tala is a mobile lending application that offers unsecured personal loans to Filipinos. It is similar to other online loan apps in that the application is paperless and the loan approval process takes minutes. Tala loans range from PHP 1,000 to PHP 30,000, with a repayment period of 21 days to four months. Interest rates for Tala loans range from 11% to 15%.

OLP - Fast Approval Loan App

OLP is an instant approval online loan app in the Philippines that offers fast loans without collateral. The loan app requires applicants to provide basic personal information, such as name, phone number, and age, and a valid government ID. Loan amounts range from PHP 1,000 to PHP 10,000, with a repayment period of 15 to 30 days. Interest rates for OLP loans can vary based on the loan amount and repayment period.

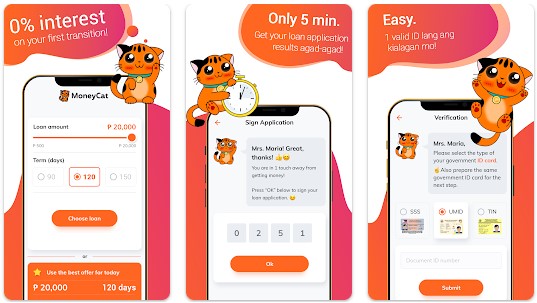

Moneycat

Moneycat is a financial technology company in the Philippines that offers online lending services. The company aims to make borrowing money easier, faster, and more accessible to Filipinos who need funds. With just a few clicks, people can apply for a loan and receive funds within 24 hours. Moneycat ensures transparency by showing the exact amount of the loan, the interest rate, the repayment period, and the total amount that needs to be paid.

Read more: The Best Small Business Ideas in the Philippines

Additionally, the company allows borrowers to manage their loans and repayments online, making it convenient and hassle-free. Moneycat is a great choice for those who need quick cash but don't want to go through the traditional loan application process.

The LoanChamp is a digital platform that offers hassle-free loans at competitive rates. With LoanChamp, you can get a loan anytime, anywhere, without going through the traditional banking system. The platform has an easy-to-use interface that makes the application process quick and straightforward. LoanChamp caters to all kinds of borrowers, from students to small business owners, and provides flexible loan options to suit their needs. The platform also provides excellent customer service and support to help borrowers throughout the lending process. Overall, LoanChamp is an excellent choice for anyone looking for a fast and reliable loan service.

Crawfort is a licensed moneylender that specializes in providing personal loans to individuals who need quick access to cash. They offer a range of loan packages that cater to different types of borrowers with varying credit histories. The loan application process is straightforward, and borrowers can expect to receive their loan disbursement within a few days. Crawfort also offers flexible repayment terms and competitive interest rates, making it an attractive option for those in need of financial assistance. With a solid reputation in the industry, Crawfort has helped many Philippines and Singaporeans overcome financial difficulties and achieve their goals.

Read more: Looking for the Best Credit Card in the Philippines 10 Best Money Earning Apps in the Philippines

Conclusion

In conclusion, instant approval online loans in the Philippines have provided a convenient alternative to traditional lending options. With the increasing number of online loan apps and the ease of application, Filipinos can access the necessary funds quickly and efficiently. It is important to choose a reputable lender and compare the loan terms before applying. When used responsibly, instant approval online loans can be a practical solution to cover emergency expenses.